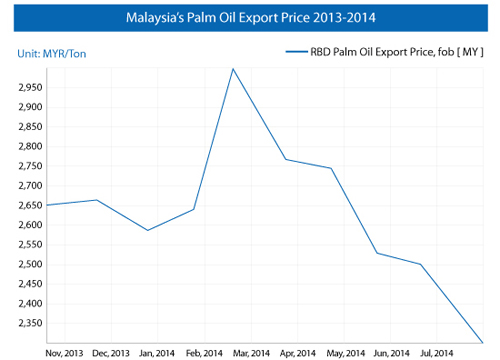

Malaysian Palm oil shipment tax to remain at zero until the end of February

Malaysia removed the duty for September and October and extended the waiver for more months to try to curb the building up of reserves and support prices of its most valuable farm-commodity export.

While the move helped spur a bull market, futures still lost 19% as demand for the tropical oil used in food and biofuels fell amid a global glut and a slump in crude prices. Data yesterday showed Malaysian reserves climbed to the highest level since February 2013.

Shipments from Indonesia are also duty-free as the government kept its tax at zero for December. The country sets its tariff according to a formula based on average prices in Jakarta, Rotterdam and Kuala Lumpur. Crude shipments attract no tax if the average rate is US$750 a tonne or less over a four-week period.

Malaysia's palm oil export price 2013-2014

Leave A Message

If you want to know more information about palm oil extraction machine. pls kindly leave your phone number, We will back to you ASAP once we got your message.

- QDo you want to buy machine?

- Yes, I want to buy machine.

- No, I want to learn more in advance.

- QWhat oil seeds do you want to process?

- Palm fruit

- Palm kernel/nut

- Peanut/Groundnut

- Soybean/Soya bean

- Sunflower seed

- Cottonseed

- Rapeseed/Canola

- Dried coconut

- Rice bran

- Corn germ

- More than two oilseeds:

- Other:

- QHow many tons palm fruit bunches will you process per day?

- 1-10 tons per day

- 10-30 tons per day

- 30-50 tons per day

- 50-100 tons per day

- QWhat machine do you want?

- Palm oil presser

- Other single machine (thresher, clarification tank, vibrating screen, filter...)

- Palm oil pressing line (from FFB to crude oil)

- Palm oil refining line (to produce refined, bleached, deodorized oil)

- Palm oil bottling / filling line

- QWhat machine do you want?

- Palm oil pressing line (from FFB to crude oil)

- Palm oil refining line (to produce refined, bleached, deodorized oil)

- Palm oil bottling / filling line

- QHow many tons oil seeds will you process per day?

- 1-20 tons per day

- 20-50 tons per day

- 50-100 tons per day

- QWhat machine do you want?

- Oil presser

- Other single machine (cracker, crusher, roaster, filter...)

- Oil pressing line (from seeds to crude oil)

- Oil refining line (to produce refined, bleached, deodorized oil)

- Oil bottling / filling line

- QWhat machine do you want?

- Oil presser

- Oil pressing line (from seeds to crude oil)

- Oil solvent extraction line

- Oil refining line (to produce refined, bleached, deodorized oil)

- Oil bottling / filling line

- QWhat machine do you want?

- Oil pressing line (from seeds to crude oil)

- Oil solvent extraction line

- Oil refining line (to produce refined, bleached, deodorized oil)

- Oil bottling / filling line

-

How lucrative is the palm oil business, and is it worth investing in?

-

-

How much it will cost to set up a small scale palm oil mill in Nigeria?

-

-

6 Reasons Why Palm Kernel Oil Production in Nigeria is a Smart Investment

-

How can I get palm kernel oil in a palm kernel oil processing plant?

-

-

Why you can invest in palm oil processing business in Ghana?

-

What are reasons that affect the oil yield of palm oil press?

-

How much does it cost to setup a mini palm oil refining plant?

-

2tph Palm Oil and Palm Kernel Oil Processing Machines Project in Nigeria

-

-

-

1tph palm oil pressing machines successfully installed in Lagos, Nigeria

-

-

-

-

500kg/h palm oil and palm kernel oil processing plant project in Ghana

-

-

30tpd palm oil refinery and fractionation plant project successfully installed in Uganda